The equity market, also known as the stock market, is a platform where shares of publicly traded companies are bought and sold. It plays a crucial role in the global economy, allowing companies to raise capital and investors to gain a stake in businesses. This guide covers key concepts and strategies essential for anyone looking to navigate the equity market successfully.

Single Investment Strategy

A single investment strategy is a focused approach to investing that aligns with your financial goals. By sticking to one strategy, you can streamline your decision-making process and reduce the complexity of managing multiple strategies. Common single investment strategies include growth investing, value investing, and dividend investing.

Quality Growth, Value, and Momentum

Quality Growth

Quality growth investing focuses on companies with strong fundamentals and sustainable growth prospects. These companies typically have robust revenue growth, high profitability, and a competitive edge in their industry.

Value Investing

Value investing involves identifying undervalued stocks that are trading below their intrinsic value. This strategy requires a keen eye for financial analysis and patience, as the market may take time to recognize the true value of these stocks.

Momentum Investing

Momentum investing capitalizes on market trends by buying stocks that have shown upward price momentum and selling those with downward trends. This strategy relies on the principle that stocks that have performed well in the past will continue to do so in the near future.

Qualities of Successful Investing

Successful investing requires a blend of discipline, patience, and continuous learning. Key qualities of successful investors include:

- Research-Oriented: Conduct thorough research before making investment decisions.

- Discipline: Stick to your investment strategy and avoid impulsive decisions.

- Patience: Understand that investing is a long-term game and avoid getting swayed by short-term market fluctuations.

- Adaptability: Be willing to adapt your strategy based on changing market conditions and new information.

What to Avoid While Choosing Companies to Invest In

When selecting companies to invest in, avoid common pitfalls such as:

- Chasing Hot Stocks: Avoid investing based solely on hype or short-term performance.

- Ignoring Fundamentals: Pay attention to a company’s financial health, management quality, and competitive position.

- Overlooking Risks: Consider potential risks and how they might impact your investment.

Investing Mistakes to Avoid

Avoiding common investing mistakes can save you significant losses. Some mistakes to watch out for include:

- Overtrading: Frequent buying and selling can erode your returns due to transaction costs.

- Failing to Diversify: Concentrating your investments in a few stocks can increase risk.

- Emotional Investing: Making decisions based on emotions rather than logic and analysis.

Factors Affecting the Equity Market

The equity market is influenced by a variety of factors, including:

- Economic Indicators: GDP growth, unemployment rates, and inflation.

- Geopolitical Events: Political stability, trade policies, and international relations.

- Market Sentiment: Investor confidence and market trends.

Understanding these factors can help you anticipate market movements and make informed decisions.

Understanding Business Models

A business model describes how a company creates, delivers, and captures value. When evaluating a company, consider:

- Revenue Streams: How does the company make money?

- Cost Structure: What are the major costs involved in running the business?

- Value Proposition: What unique value does the company offer to its customers?

Company Analysis

Effective company analysis involves examining financial statements, ratios, and other key metrics. Focus on:

- Income Statement: Understand the company’s revenue, expenses, and profitability.

- Balance Sheet: Analyze the company’s assets, liabilities, and equity.

- Cash Flow Statement: Assess the company’s cash inflows and outflows.

Industry Analysis

Industry analysis helps you understand the competitive landscape and identify trends. Key aspects include:

- Market Size and Growth: How large is the industry, and what is its growth potential?

- Competitive Dynamics: Who are the major players, and what are their market shares?

- Regulatory Environment: What regulations impact the industry?

Economic Conditions

Broader economic conditions significantly impact the equity market. Key indicators to monitor include:

- Interest Rates: Influence borrowing costs and consumer spending.

- Inflation: Affects purchasing power and corporate profits.

- Economic Cycles: Expansion and contraction phases of the economy.

By understanding these fundamental concepts and strategies, you can enhance your investment acumen and navigate the equity market with greater confidence. Whether you’re aiming to build a robust portfolio or simply make more informed investment decisions, this knowledge will serve as a valuable foundation.

Are you ready to dive into the exciting world of equity markets? Our comprehensive course is designed to provide you with the knowledge and skills you need to succeed in the stock market. Whether you’re a beginner or an experienced investor, this course will equip you with the tools to make informed investment decisions and achieve your financial goals.

Why Choose Our Equity Market Course?

- Comprehensive Curriculum: Covering everything from basic concepts to advanced strategies.

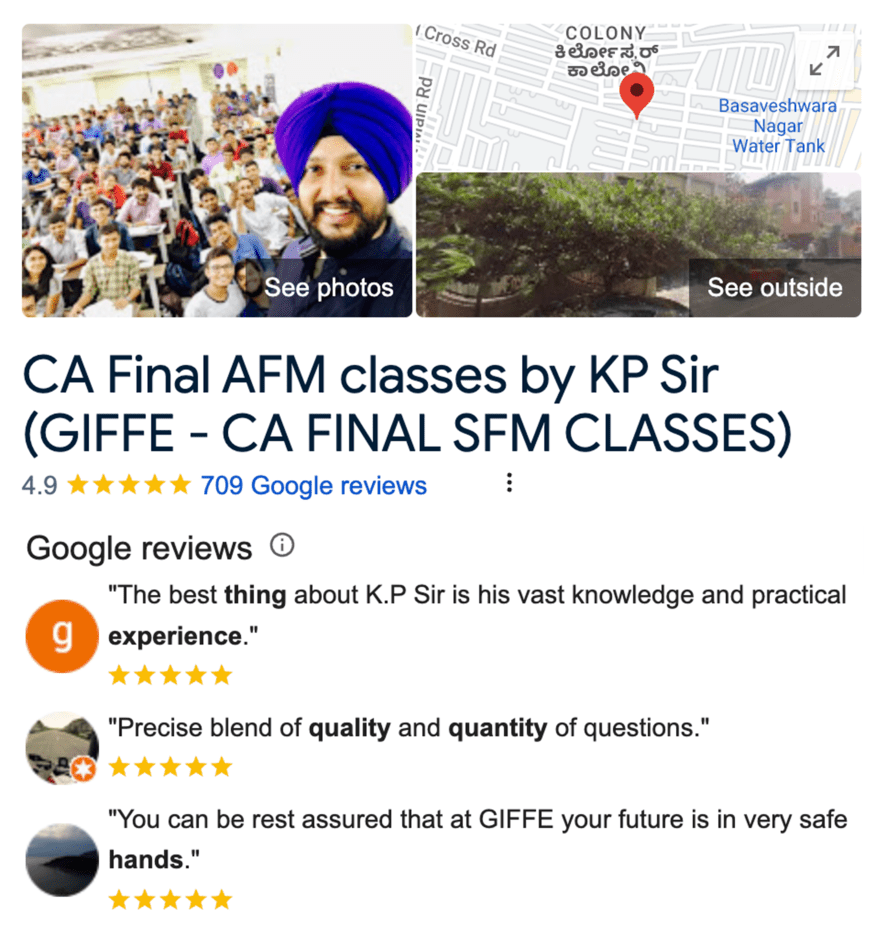

- Expert Instructors: Learn from experienced professionals in the field.

- Interactive Content: Engage with videos, quizzes, and real-life case studies.

- Flexible Learning: Access the course material anytime, anywhere.

Take the first step towards becoming a confident and successful investor. Enroll in our equity market course today and unlock the potential of the stock market.

Testimonials

“This course transformed my approach to investing. Highly recommended!”.

“A must-take for anyone serious about the stock market.”

FAQs

Q: Who is this course for?

A: This course is for anyone interested in learning about the equity market, from beginners to experienced investors.

Q: How long is the course?

A: The course is designed to be flexible, allowing you to learn at your own pace. Most students complete it within 6-8 weeks.

Q: Will I receive a certificate?

A: Yes, upon successful completion of the course, you will receive a certificate.

For more information, feel free to WhatsApp us at 9663487212. Ready to start your journey in the stock market?